Distributions & distribution plans for performers

GVL pays out money to its rights holders in regular distributions. We calculate your remuneration based on the exploitation of productions to which you contributed: If they are broadcast via radio or TV, for example, you will get your remuneration paid by GVL.

You can take a look at an overview on current and pending distributions, our distribution cycles and our principles of calculation, the distribution plans, here.

Further questions are also answered in our Q & A.

Current distributions

Here, you can view our distribution schedule for the current year.

Very important! Please understand that, at this time, we cannot commit to provide binding details on the month of the scheduled distribution. We coordinate a multitude of distribution-related steps for our various rights holder groups (performers, producers of sound recordings and event organisers). Since in this process, some of the same resources are required, we cannot exclude that small delays occur beyond the end of the month.

Distribution process

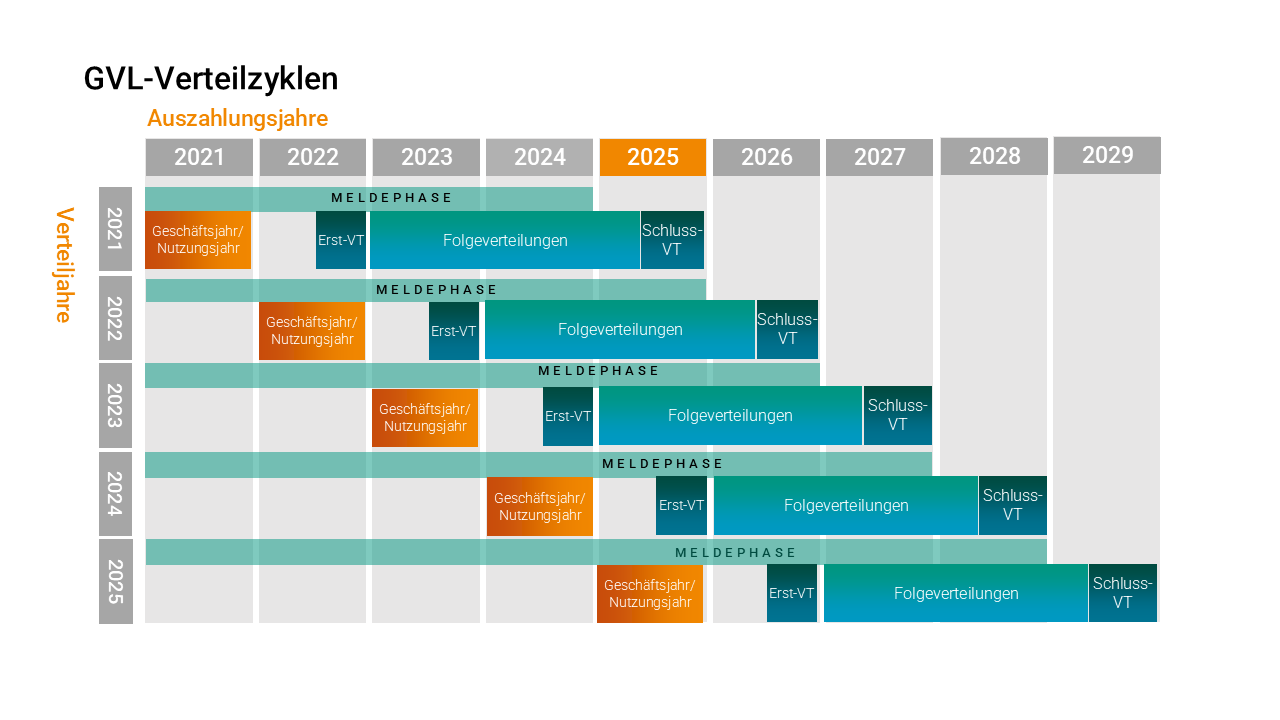

A distribution period consists of the registration phase, the initial and follow-up distributions and the final distribution.

Registration phase

In principle, every right holder has three years to report contributions to productions (e.g. music, movies & series). The registration phase ends with the registration deadline by which registrations from rights holders must be received in order for them to be entitled to remuneration.

Initial and follow-up distribution

After an initial distribution, at least two follow-up distributions are due, in which, for example, newly reported participations are remunerated, individual parameters are recalculated or subsequent income is distributed. Remuneration received by beneficiaries in the initial and follow-up distributions are interim amounts until the notification phase has expired and it is clear how many beneficiaries have registered an entitlement to remuneration from the distribution year.

Final distribution

The final distribution takes place after the end of the registration phase. All remuneration reserved for the respective distribution year but not yet claimed is then released and paid out to all beneficiaries with existing registrations. The final distribution ends the distribution cycle.

Here you can see an overview of the current distribution cycles.

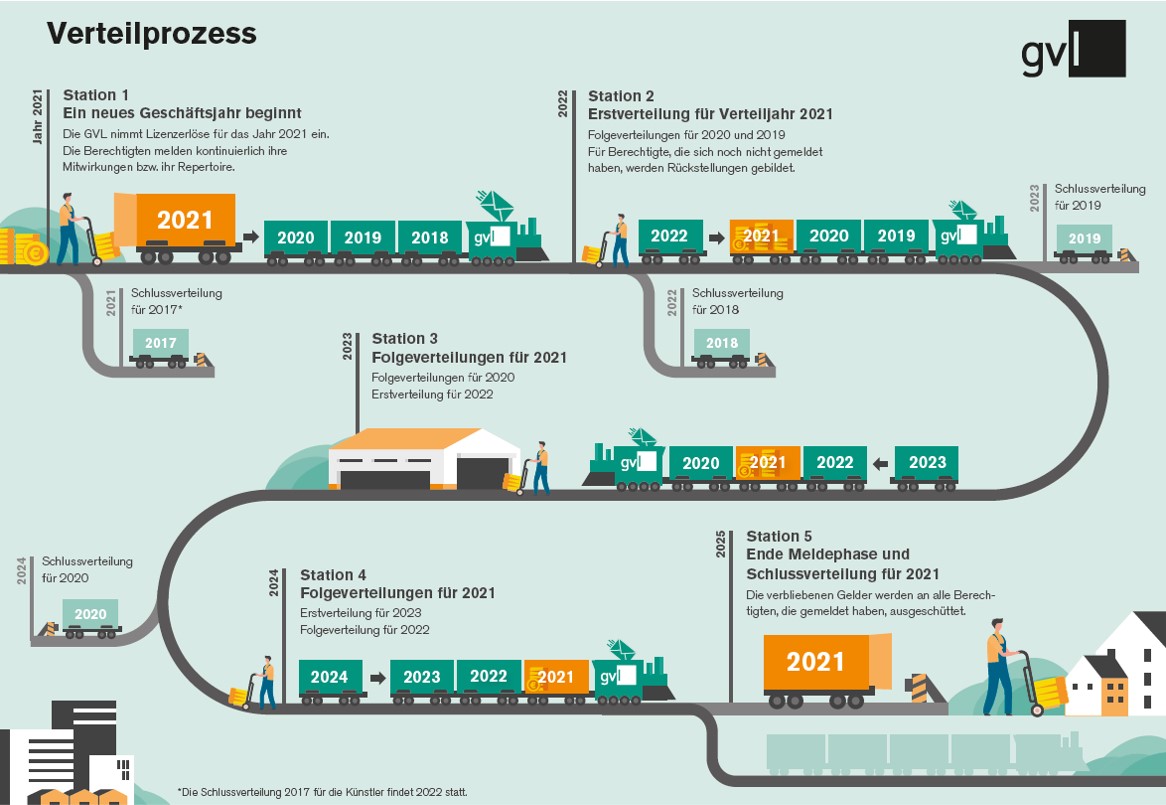

This is what the distribution cycle of a year looks like, shown here based on the 2021 example:

Distribution calculation

Your individual remuneration entitlement depends on various parameters. In general, the type and intensity of your contribution, and the format and scope of how the relevant production is exploited are decisive. Above and beyond that, the specifications for the distribution calculations are decided each year by the Assembly of Shareholders and Delegates and subsequently published in our distribution plans.

Your individual remuneration entitlement is determined in four steps:

- You, the rights holder, submit a notification of the type and scope of your contribution(s) to a production. GVL now determines the creditable category points for your contribution to the production based on the information you provided on role and, where applicable, function, as well as shooting days/dubbing takes and further parameters. Distribution plans as determined by the Assembly of Shareholders and Delegates form the basis for this.

- Provided that GVL has been notified that a production was used by one of the broadcasters subject to analysis in the relevant distribution year, the actual usage duration of the production in the relevant distribution year will act as the basis for the calculation. It will then be multiplied with various factors ("weighted") in order to obtain the creditable usage units of the production. Our distribution plans provide different degressive tiers depending on the production type.

- The next step is to multiply the individually creditable category points of the contribution with the creditable usage units calculated for the relevant production. The result are the individual contribution points valid for the contribution registration.

- In order to be able to determine the remuneration entitlement for your contribution, the contribution points calculated in the previous step are multiplied with the current monetary value per contribution point. The final result is your remuneration entitlement for your contribution registration.

In order to calculate the total remuneration that you are entitled to, steps 1-4 are repeated for each of your contribution registrations. The final grand total thus calculated is paid out to you in the course of the distribution.

Individual and general deductions from the collections arising from rights including the principles governing the deductions for offsetting administrative costs shall generally be made in accordance with the cause of the cost. Further details are currently in our annual report. Our annual reports can be viewed here. From 1 September each year, GVL will provide a comprehensive transparency report where you can read about all important information relating to collections and deductions.

Up to 5% of the revenue available for distribution may be used for cultural, cultural-political and social purposes. Guidelines for cultural-political allocations can be accessed here. Non-distributable collections from the rights will be dissolved and included in supplementary distributions on an accrual basis. Collections arising from rights shall be considered as non-distributable if the identity or whereabouts of the rights holder could not be established within three years after the financial year has lapsed where the remuneration was collected for the relevant rights and if GVL had undertaken the necessary steps to establish the rights holders.